Why score legacy products?

Legacy products may be of interest to financial advisers wishing to provide advice on retention, addition, or disposal of a currently held contract which is in a closed product group no longer receiving upgrades, or receiving limited upgrades.

Insurer product teams an in-house client advice teams may similarly wish to understand the differences between the closed product and on-sale products.

The value of legacy product research

We estimate that more than 95% of these legacy policies require some form of individual research to enable an adviser to confidently advise on business replacement. A Financial Advice Provider needs to be able to confidently address the differences between an existing policy and a possible new policy to provide advice on retention, disposal, or replacement of the business.

Definition of a legacy product

A legacy product is one that is no longer on-sale and is not covered by the enhancement pass-back or policy upgrade provisions. We have a library of more than 1,000 policy documents and although some will have very few policyholders, the top 200 contracts may have more than 500,000 policies that remain in force. If you are contemplating the use of legacy research, we first suggest:

1.Familiarise yourself with the pass-backs offered by insurers. You can find a guide to passbacks directly on Quotemonster or download one here.

2.Make yourself aware of the risks of advice on legacy contracts, whether that is retention, addition to the contract, or replacement – a good statement of risks is included in the Advicemonster statement of advice template wording.

How do we know what is legacy and what is equivalent to modern product due to a pass back?

Where an insurer provides us with sufficient information to assess what is passed back, we will provide a table so that the user can check and ascertain when current research is applicable. Where it is clear there is no pass back, we shall refer to new legacy research. Where it is uncertain, we shall warn that the pass back is not clearly added to the current contract. We think it is advantageous that if you have substantial pass back commitments that can be clearly identified then you should supply us with that information as they will compete most effectively based on modern wording. Most packages of cover on modern wordings from adviser-focused companies perform to a high standard and very closely to their peers. A modern product within a single digit number of percent of a near equivalent does not, in our view, present a strong case for replacement. In fact, replacement may well be hazardous. But replacement business decisions are not ours: they will be for the financial advice provider to consider and recommend and for the client to take. Pass back rules are to be surveyed and supplied as part of the process. It will be the responsibility of the Financial Advice Provider to assess whether a product will qualify under these pass back rules or should be considered a legacy product. That is because an individual product may have been changed by endorsement.

What does the research look like?

Although this may change by agreement, currently, we plan to offer a simplified form of legacy product research and to make it available perhaps exclusively to the larger adviser groups and insurers that would use it the most while we work on building up the ‘catalogue’ of researched legacy products. The research would cover three areas:

- A check for any major faults or limitations which make detailed research unnecessary. For example, American Income Life offers a cancer-only insurance product which has tough qualification criteria – that statement alone would be sufficient demonstration of the gap between its coverage and most modern contracts.

- A review of the most important features: e.g., the main benefit for life cover; cancer, heart attack and stroke for critical illness, and so on – all done with the same level of detail as the current research, with scores based on our four-factor methodology to ensure that they are properly weighted.

- A review of the presence or absence of minor features The latter two components would be used to calculate a score range that is comparable to a modern score in our system. So, for example, if your current product scores 120 points, a limited legacy product may score 60 to 89 points based on accurate scoring of the most important items and worst to best scoring of the minor features. It would be a summary of this assessment.

Handling previously researched products

- Previously researched products will be identified and listed and checked against current pass-back rules

- Those with pass-backs will be tagged as passed back

- Those without a pass back will be compared using the following process

- A previously researched product will be compared to the ‘best current’ score in the latest database version.

- Current products will be compared to the unadjusted ‘best possible’ score in the current database version.

- The resulting scores will be added to the legacy research database and a summary report commentary will be added

Research process for an identified case:

- Is this the current product?

- Is it subject to pass back rules?

- What is the policy document?

- Fatal issues review – an issue that makes the product non-comparable in some fundamental way

- Identify top items (that account for approximately 80% of score) for review and conduct a review of these leading items

- Check each benefit in the legacy product to see if it is present in rating – mark the balance of items as gaps

- Assess best possible scores for non-assessed items

- Assessed QPR-legacy score

- Comparison with a perfect score

- Write Commentary

Rating areas excluded:

We will provide no evaluation of:

- Price

- Exclusions or endorsements specific to the individual

- Product not offered by a New Zealand insurer

- Products where the document is incomplete

- Products where the insurer states that they are covered by pass backs

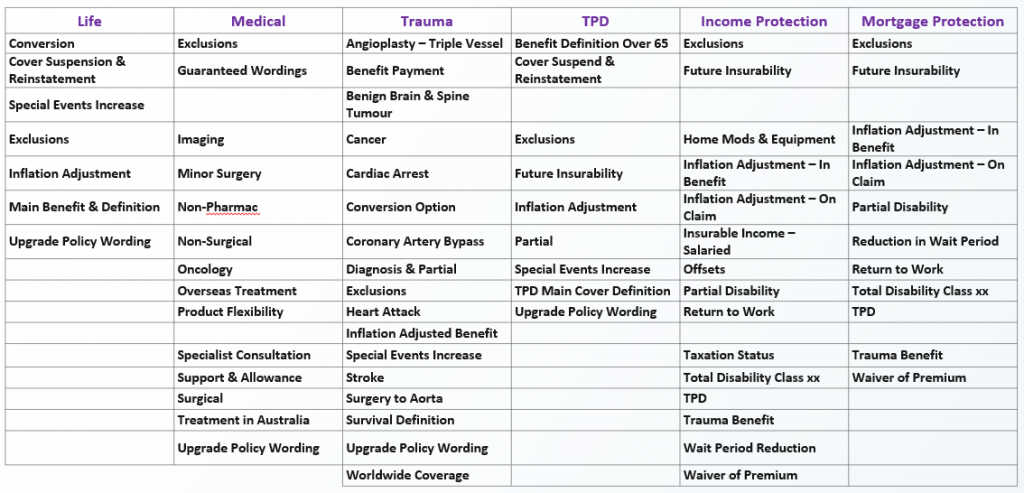

An example of items we re-rate

Your feedback

We value getting your feedback on the subject and if you have any you would like to share with us, please email us on [email protected]