Introduction

Childhood trauma is one of the most unfortunate realities that few parents will face in their lifetime. Although modern medicine has decreased the rate of childhood illness, those that are in this position will be relieved to know that most Life and Health insurers include financial assistance in the form of a Child Trauma benefit.

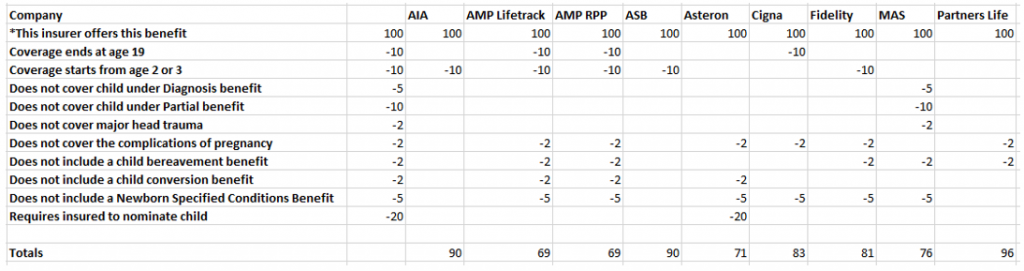

These are the factors in the definition score that currently differentiate between insurers in our rating database.

Sub-items rating review

Notes

You will notice that the sub-item “Requires insured to nominate child” has the highest deduction for this benefit. Asteron is the only provider that we have found to currently include this criterion. The provider requires the insured to complete a medical assessment for each child before they can be covered under this benefit.

The highest variation between insurers is in the coverage age. The optimal coverage age is from new-born to age 21 (few providers offer this).

We have recently added two additional subitems to reflect whether insurers offer Partial and diagnosis benefits. Interestingly many do include these in their policy wording.

Why is this important?

Parents/caregivers will be pleased to find that this benefit is included in their own Trauma Cover, at no additional cost. The future impact of a childhood illness, injury or accident can be very detrimental to a family’s wellbeing and livelihood.

Your feedback

We value getting your feedback on how these wordings are being applied to claims you may be aware of. Please email us with details of any recent claims to help us update our understanding.

Doreen Dutt, Research Analyst, Quality Product Research Limited, [email protected]