Introduction

The rising costs of specialist imaging and medical tests really shows the importance of having medical coverage in the world we live in today.

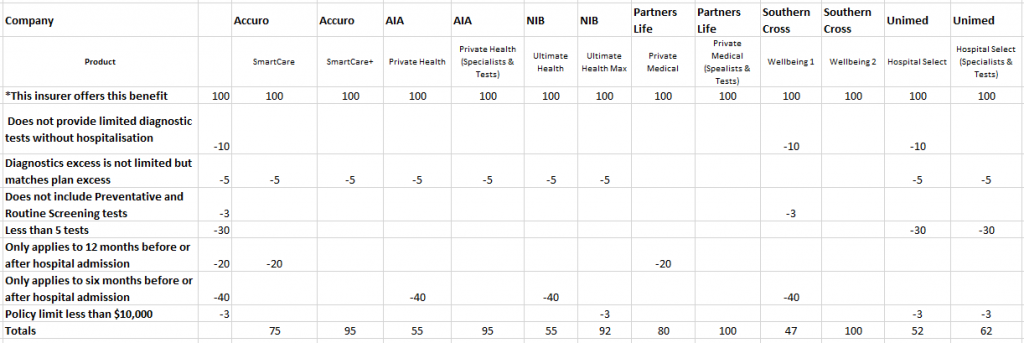

An adviser recently informed us of a significant feature two insurers have included in their Diagnostic Tests benefit. Partners Life will apply a $250 standard excess for these claims, regardless of if the selected excess is $250 or above. Furthermore, in a policy year, the excess will only be deducted once at the first claim, then no additional excess will be applied in that period. In contrast, Southern Cross does not apply any excess for their Diagnostic Imaging or Tests, however, these will need to be performed by an affiliated provider.

To reflect this in our Research ratings we have added the following sub-item:

“Diagnostics excess is not limited but matches plan excess”

To clarify, the providers that will apply the selected excess for a Diagnostics Tests claim will have a deduction for this sub-item, while those that offer a lower or nil excess will not.

Why is this important?

This is an example of a significant difference that we are able to capture in our Definition scoring. While a lowly weighted item, it surely is important to those customers that have selected high excesses and would not be eligible for a Diagnostic Tests claim with other insurers.

Your feedback

We value getting your feedback on how these wordings are being applied to claims you may be aware of. Please email us with details of any recent claims to help us update our understanding.

Doreen Dutt, Research Analyst, Quality Product Research Limited, [email protected]